Should a Trust be a Beneficiary of My IRA?

It’s generally a bad idea to name a trust as beneficiary of your IRA.

It’s generally a bad idea to name a trust as beneficiary of your IRA.

Done right by a lawyer, your heirs can avoid the expense and time of probating your will and may save on estate taxes, while easing the administration of your affairs while alive and after you have gone.

Every family has one–or maybe more–black sheep. They’re people who march to their own drum and handing them an inheritance could be problematic.

Taking a few simple steps now can potentially help save your beneficiaries thousands in legal fees and taxes.

Remember that a will goes through probate, so a husband and wife typically try to avoid it by using joint ownership or beneficiary designations. However, they’re often mistaken by believing the will still controls their estate.

The inheritance you leave could be eaten away by taxes or given to the wrong person. Here are five tips to avoid that.

Most people wish to have more control over who and how their assets are managed than what the state laws provide, and so they draft documents that can override the Laws of Intestacy, when those laws do not match their objectives.

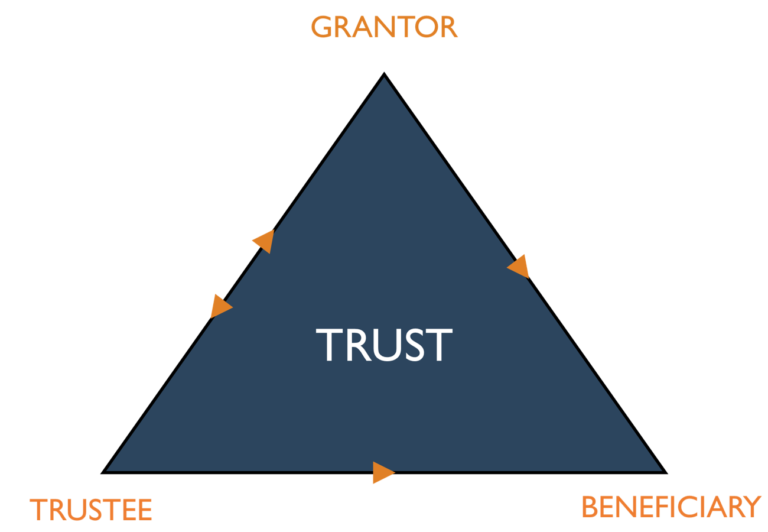

The distribution of some of our assets can be governed by contracts. Examples of these contracts include life insurance, investment accounts, bank accounts and trusts.

The list of things you need to do after someone dies can seem endless, especially during a time when you are also grieving.

My daughter, my only child, recently married a nice man. However, he is not responsible with his finances. I don’t want my son-in-law to have any access to her money or through a divorce via equitable distribution.