How Do Estate Plans and Trusts Work?

In this article, we will address two terms which some people use interchangeably, but which are very different things: living trusts and estate plans.

In this article, we will address two terms which some people use interchangeably, but which are very different things: living trusts and estate plans.

These agents take over your affairs in specific areas, if you become physically or mentally incapacitated.

Both help you pass down assets, while avoiding the time and expense of probate. However, one has much more flexibility than the other.

If you’re merely dipping your toe in cryptocurrency, it can be hard to imagine your crypto as something worth talking to an estate attorney about. But that $100 in fun money could grow to a significant percentage of your total investments, sometimes overnight.

As you know, a power of attorney (POA) allows another person, the Attorney-in-Fact (AIF), to conduct business on behalf of the principal. The POA authorizes the AIF to sign for and on behalf of the principal.

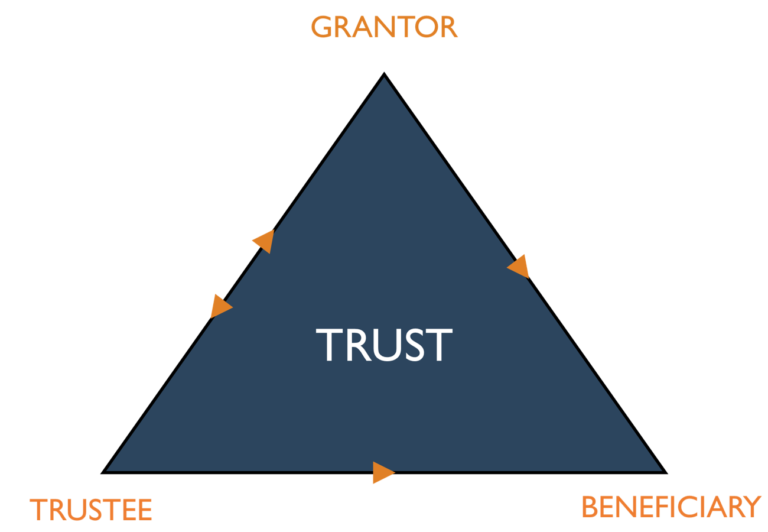

A trustee is a fiduciary which, essentially, is a person that owes a legal, ethical and, perhaps, moral obligation to act in the interest of another.

Beneficiaries, in general, are people or entities that the holder of an account designates to receive the assets in the account, typically, in the event of the account holder’s death.

You can reduce stress and expenses for yourself and your family, if you develop an estate plan that includes these important documents.

What are the advantages of putting assets into a trust?

Have you made any plans to distribute your assets and take care of your family, when you die or become incapacitated?