Different Trusts for Different Purposes

Trusts are legal entities that own assets, and all trusts are not alike. They are created by a written trust document with certain provisions that can vary from trust to trust.

Trusts are legal entities that own assets, and all trusts are not alike. They are created by a written trust document with certain provisions that can vary from trust to trust.

For example, did you name someone as an heir who is no longer in favor with you or—worse yet—has died? Who should get what they would have gotten? Are there now new people in your life—be they family members or not—whom you might wish to share in what you may have?

One problem that frequently stems from the inheritance process is fractured relationships between siblings. Unfortunately, the common denominator in many of these situations is the parents’ estate plan.

Whenever you open a financial account, you’re almost always asked to name a beneficiary. Simply stated, a beneficiary of the account is someone who is entitled to the benefits of the account, typically, on the death of the account holder. If you’ve purchased life insurance, for example, you name a beneficiary, who receives the benefits of the policy when you pass.

It’s never too early to start working on how your things will be handled, once you pass away.

Somewhere between a corporation and a partnership lies the limited liability company (LLC). This hybrid legal entity is beneficial not just for small-business owners but is also a powerful tool for estate planning.

Estate planning documents often are treated like the photocopied permission slip for a child’s field trip. You fill in your name, include the children’s names and dates of birth and sign. The document is filed away to be used if needed, but you really never expect it to be used.

The in-court fights between Hawkeye actor Jeremy Renner and his ex-wife Sonni Pacheco have not slowed, despite current world events.

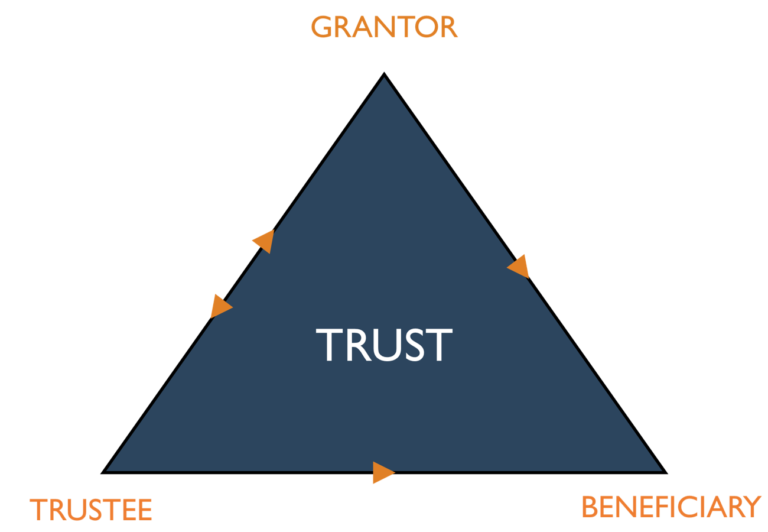

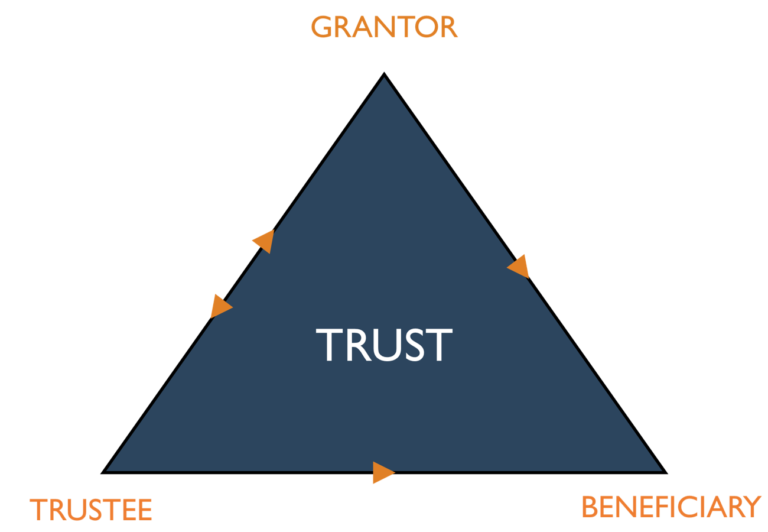

Before taking a closer look at revocable and irrevocable trusts, it helps to know what a trust is. In simple terms, it’s a legal entity that allows you to transfer assets to the ownership of a trustee.

A trust can be used to manage estate taxes, shelter assets from creditors and pass on wealth to future generations. A family trust is a specific type of trust that families can use to create a financial legacy for years to come. There are several benefits to creating one, although not every family necessarily needs one. If you’re curious about where this type of trust might fit into your family’s estate plan, here’s what you need to know.