Where Do You Score on Estate Planning Checklist?

Every so often, it’s smart to methodically go through your estate planning documents and see if any tweaks are needed. Here’s a checklist to guide you through that mission.

Every so often, it’s smart to methodically go through your estate planning documents and see if any tweaks are needed. Here’s a checklist to guide you through that mission.

Social Security benefits serve an essential role in most Americans’ retirement plans. Yet many people — even soon-to-be retirees — know little about how the program works or how to get the most from the benefits they’ve earned.

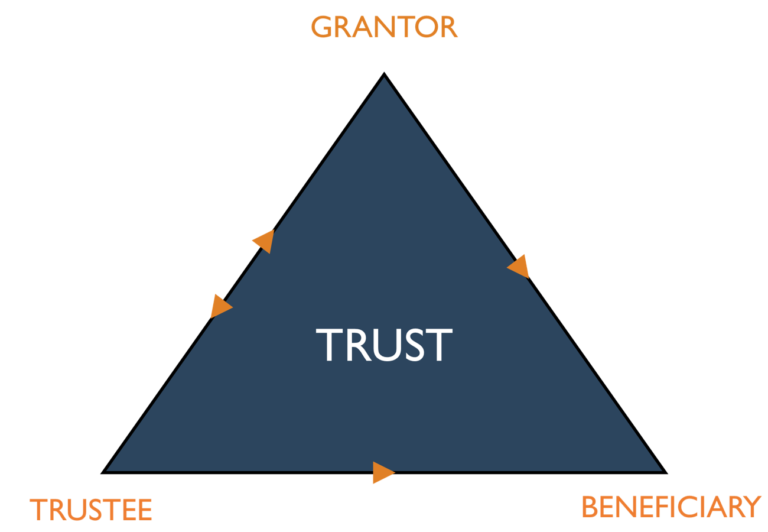

I’m a trustee selling a home in irrevocable trust for a parent who died. There are two beneficiaries who will get the sale proceeds with a stepped-up basis. I’m filing Form 1041 but do I still have to file a Form 1040 to report anything for the beneficiaries?

The bill for long-term care adds up fast. The annual median cost for a private room in a nursing home was $105,850 in 2020, according to Genworth. The government could pick up these costs if you qualify for Medicaid, but that’s easier said than done.

You should start by talking to an estate planning attorney who can look at your assets and income and see what impact they will have on Medicaid eligibility.

Have you made any plans to distribute your assets and take care of your family, when you die or become incapacitated?

One of the best ways to prepare for retirement is to set aside money in a tax-advantaged retirement account. Hopefully, you have done so year after year and built a nice nest egg.

While most initial meetings with an estate planning attorney will result in some questions you likely have never considered, there are many ways in which you can prepare for a thoughtful and productive estate planning conference that will result in a better understanding of your goals and more efficient use of time with your attorney.

If you’re helping an aging parent navigate Medicaid because they don’t have long-term care insurance or you think you’ll need it yourself someday, it’s important to understand how the program works.

It’s generally a bad idea to name a trust as beneficiary of your IRA.