Your Estate Planning Checklist for 2021

Early in 2021, you should communicate with your advisers and review several items about your 2020 planning, if that planning is to have any likelihood of succeeding.

Early in 2021, you should communicate with your advisers and review several items about your 2020 planning, if that planning is to have any likelihood of succeeding.

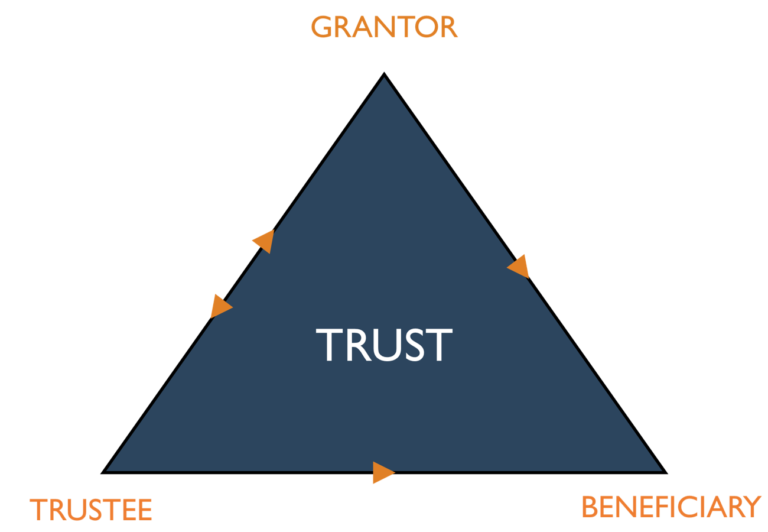

The trust is a very useful and flexible tool for estate planning, yet it is probably the most underused estate management technique. A trust is an artificial entity, something like a corporation, created by a document or instrument.

A tiny home in retirement could be a more-affordable way to downsize and still be close to family.

Many people transitioning into an elderly life start to require assistance in their everyday lives, especially if they suffer from a chronic or end-of-life medical condition. They need help for tasks, including bathing and eating.

I am a single retired parent to an adult daughter, who is an only child. The home I currently reside for the last 26 years still has a mortgage and the deed is in my name only. I have a will that states everything is left to my daughter, and then to my grandson, if she proceeds me in death. Should my daughter be added to the deed?

If you live in a place with high pollution levels, your risk of developing dementia might be substantially increased, according to a new study.

When something is tailored to one’s needs, everything can go smoother.

Done right by a lawyer, your heirs can avoid the expense and time of probating your will and may save on estate taxes, while easing the administration of your affairs while alive and after you have gone.

A comfortable, secure retirement is one of the biggest financial goals you can strive for. Therefore, as you’re saving and investing in pursuit of it, it’s crucial to separate fact from fiction—otherwise, your plan could go off track.

Gifting sounds pretty simple, but there are many ways to do it, and several tax ramifications to be aware of as well.