The Advantages and Disadvantages of a Trust

What are the advantages of putting assets into a trust?

What are the advantages of putting assets into a trust?

Have you made any plans to distribute your assets and take care of your family, when you die or become incapacitated?

While most initial meetings with an estate planning attorney will result in some questions you likely have never considered, there are many ways in which you can prepare for a thoughtful and productive estate planning conference that will result in a better understanding of your goals and more efficient use of time with your attorney.

It’s generally a bad idea to name a trust as beneficiary of your IRA.

Depending on your family situation and the value of your estate, forming a trust can be an important addition to your farm transition plan.

Early in 2021, you should communicate with your advisers and review several items about your 2020 planning, if that planning is to have any likelihood of succeeding.

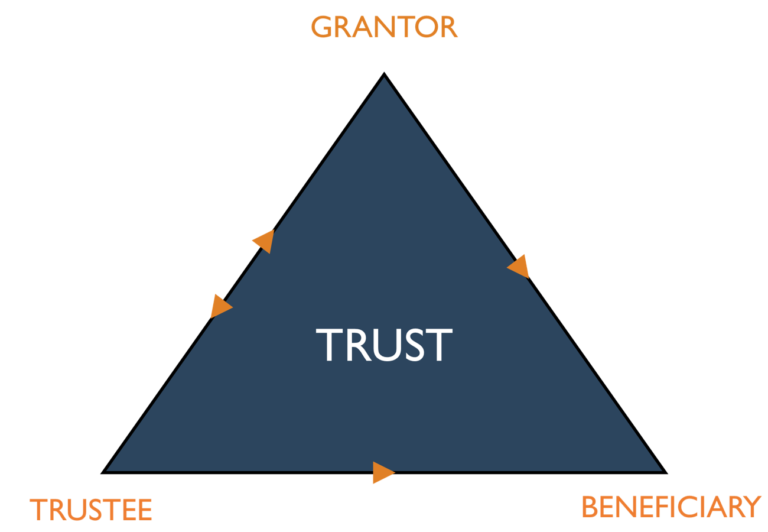

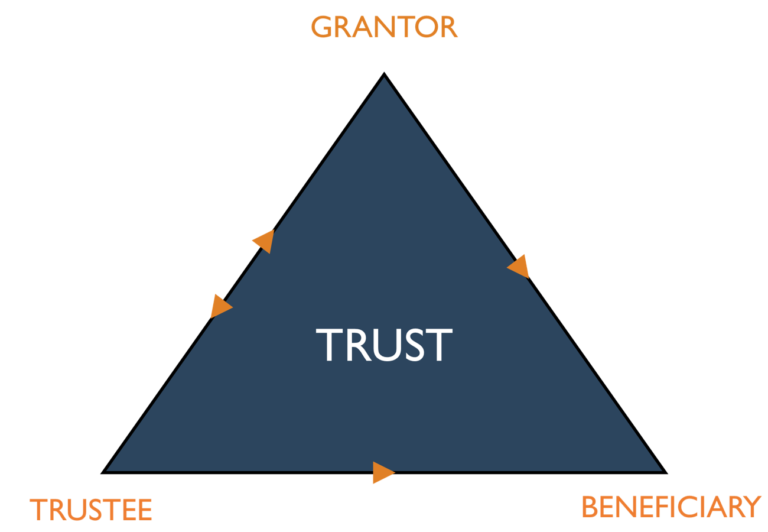

The trust is a very useful and flexible tool for estate planning, yet it is probably the most underused estate management technique. A trust is an artificial entity, something like a corporation, created by a document or instrument.

Done right by a lawyer, your heirs can avoid the expense and time of probating your will and may save on estate taxes, while easing the administration of your affairs while alive and after you have gone.

Every family has one–or maybe more–black sheep. They’re people who march to their own drum and handing them an inheritance could be problematic.

Taking a few simple steps now can potentially help save your beneficiaries thousands in legal fees and taxes.