Distributing Unequal Amounts in an Estate Plan

For most of us, considering the distribution of the property we have accumulated over our lives is a painful reminder of our mortality.

For most of us, considering the distribution of the property we have accumulated over our lives is a painful reminder of our mortality.

What happens when a decedent’s will or trust does not provide for a decedent’s child?

The distribution of some of our assets can be governed by contracts. Examples of these contracts include life insurance, investment accounts, bank accounts and trusts.

The list of things you need to do after someone dies can seem endless, especially during a time when you are also grieving.

My aunt recently asked me to be the executor of her will when she dies. I’m flattered that she asked, but I’m not sure what exactly the job entails.

We may think of a spoiled heiress to a large fortune, whose parents were savvy enough to prevent her from having full access to her funds. On the other hand, we could imagine a loved one with special needs, whose needs will be provided for with trust-protected money.

Develop a successful transition plan that will provide for you, your heirs and your business.

Windfalls can result from fortunate events, like lottery winning, and unfortunate events, like a legal settlement. Whatever the triggering event, a big injection of cash can certainly be a life-changing event in someone’s life.

Nursing homes are expensive with an average cost in the United States of $7,698 per month (2020 average). Most people cannot afford this expense, but they are in desperate need of the services provided by nursing homes (long-term care facilities).

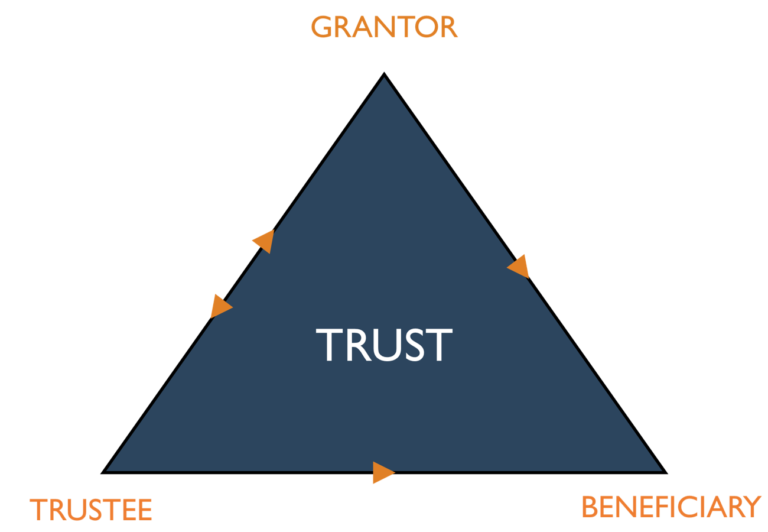

Trusts are legal entities that own assets, and all trusts are not alike. They are created by a written trust document with certain provisions that can vary from trust to trust.