What’s the Estate Tax Exemption for 2021?

The federal estate tax exemption is going up again for 2021.

The federal estate tax exemption is going up again for 2021.

Remember that a will goes through probate, so a husband and wife typically try to avoid it by using joint ownership or beneficiary designations. However, they’re often mistaken by believing the will still controls their estate.

Gifting sounds pretty simple, but there are many ways to do it. There are also several tax ramifications to be aware of.

Do you have accounts, records or information that are accessed using your mobile phone, through an internet connection, or by using a keyboard or through a touch-screen or tablet?

The SECURE Act killed the stretch IRA but instead of mourning, advisors can help clients make up the loss.

If you are the parent of a person with special needs, you are well aware that the role you play is very different than it may be for other children. Properly planning to meet their financial needs, both in the immediate and long term, is a critical part of supporting your child. This support must often continue well past the typical age of adulthood, which means parents need to put in place financial tools to care for their children, in the event of the parents’ death.

The muscles and joints are not the only parts of the body to be worn down by physical work. The brain and heart suffer too. A new study from the University of Copenhagen shows that people doing hard physical work have a 55% higher risk of developing dementia than those doing sedentary work. The figures have been adjusted for lifestyle factors and lifetime, among other things.

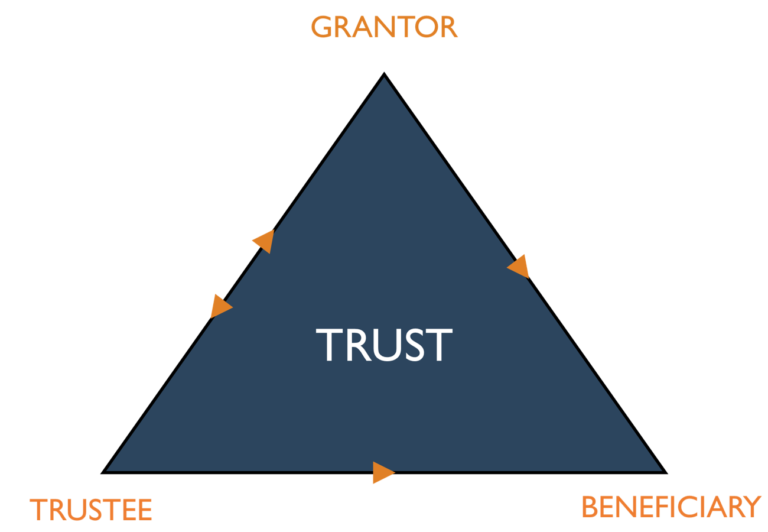

A trustee is a manager of assets in a trust. The grantor creates the trust and appoints the trustee. A trustee has a ‘fiduciary duty’ to serve the grantor and not benefit personally.

Here’s a closer look at the seven biggest changes to Social Security in 2021

Though Social Security helps millions of seniors stay afloat financially, living on those benefits alone could mean winding up cash-strapped in retirement.